A quarterly report by Messari shows a significant rise in RWAs on Solana, as BlackRock, Apollo expand funds.

Summary

- RWAs on Solana rise 124% YTD, to $390 million

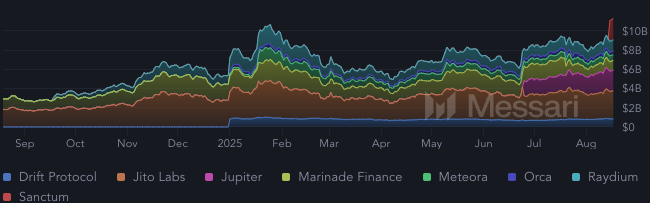

- Solana’s DeFi TVL rose to $8.6 billion, rising 30% QoQ

- Staking and liquid staking are on the rise, with 12% liquid staking penetration

Solana’s (SOL) ecosystem continues to expand, while some metrics remain mixed. On Monday, August 18, Messari Protocol Services released a quarterly report on the state of the Solana network. The report shows a significant increase in DeFi TVL and real-world assets, despite a drop in app revenue.

One of the fastest-growing segments for Solana was real-world assets. RWA value on Solana rose 124% year to date, and has reached $390 million. Leaders in this category remained Ondo Finance’s USDY, backed by U.S. Treasuries, and with a market cap of $175.3 million.

For one, Solana’s DeFi total value locked rose 124% over a yearly period, reaching $8.6 billion. This makes the Solana ecosystem the second-biggest after Ethereum (ETH). The leading protocol remains Jito Labs liquid staking platform, with $2,87 billion in TVL.

Sanctum, a newly launched liquid staking platform, managed to capture $2.18 billion in revenue just days after launch. Accompanying this rise was a significant increase in staked SOL, at $60 billion, a 25% QoQ increase. What is more, liquid staking penetration rose to 12%, with jitoSOL remaining in the lead.

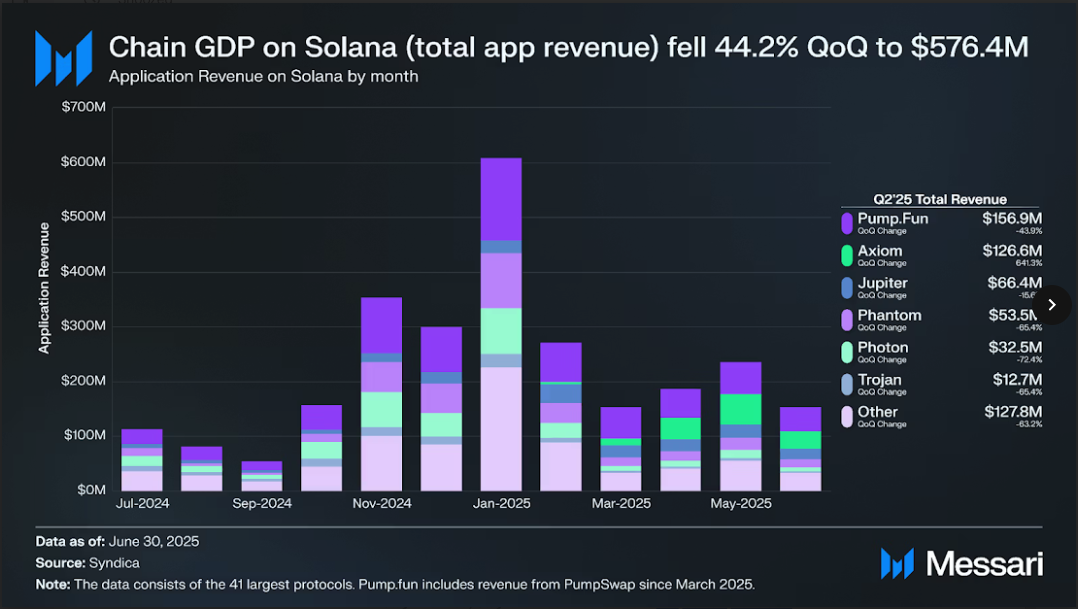

On-chain revenue drops 44% QoQ

Despite strong growth in DeFi TVL and staking, not all metrics were positive. Notably, apps registered 44% less revenue compared to the last quarter, falling to $576 million. The leader in revenue generation remains Pump.fun, with Axiom in the second place.

Despite a fall in app revenue, the share of revenue captured by applications grew from 126.5% to 211.6%. Validator fees fell even less, partially due to the new Alpenglow consensus protocol, which cuts validator costs.