Key Takeaways

- Peter Schiff claims Strategy’s investment in Bitcoin has only yielded modest returns over five years.

- Schiff argues that any other asset would have performed better than Bitcoin, offering higher returns.

Share this article

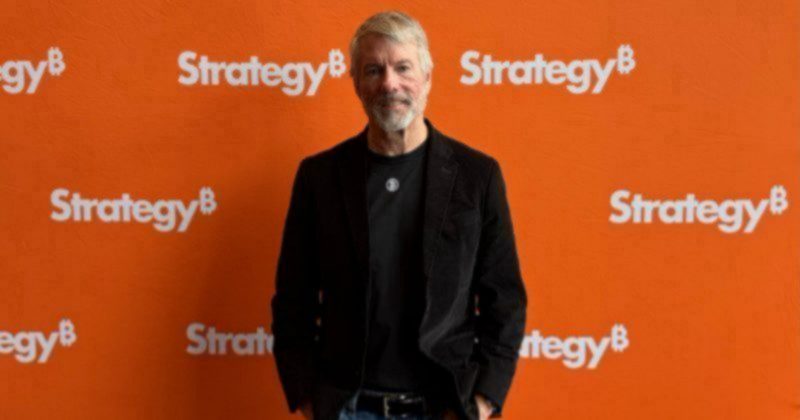

Bitcoin treasury firm Strategy would have delivered stronger returns had Michael Saylor avoided Bitcoin and allocated capital to other asset classes, said Peter Schiff, a longtime Bitcoin critic and gold advocate, in a recent statement.

“Strategy has been buying Bitcoin for five years. With an average cost of $75K, the company has a ‘paper profit’ of just 16%,” Schiff posted via his official X account. “That’s an average annual return of just over 3%.”

Strategy (MSTR) slipped in Monday trading, extending a rough year for the stock, per Yahoo Finance. Often viewed as a proxy for Bitcoin, MSTR is now 46% lower in 2025.

Schiff faced backlash from market observers following his statement.

In a comment, prominent expert Willy Woo said Schiff misrepresented Strategy’s performance by assuming all Bitcoin purchases happened simultaneously, instead of factoring in the timing of each trade. He said that led to an inaccurate view of performance.

“That’s my quant. He doesn’t even speak English.”

You need one of those Peter, before you post your math.

You averaged the cost basis but didn’t average the time basis.

Scam maths.

— Willy Woo (@woonomic) December 29, 2025

Venture capitalist Revaz Shmertz also challenged Schiff’s comparison, saying it failed to reflect how investment returns are actually calculated.

Peter, that’s not how returns work. You can’t divide paper profit by five years when buys are staggered across the whole period.

And “any other asset” is doing a lot of heavy lifting. Now I ask you:

– Which asset?

– With what drawdown tolerance?

– At what entry timing?…— Rezo🛡₿RRR (@rezoshm) December 29, 2025

Strategy announced this morning a 1,229 Bitcoin purchase, boosting its holdings to 672,497 BTC.

Alongside Bitcoin accumulation, the company also raised its cash buffer to $2.2 billion, ensuring that it can meet all financial obligations for the next few years without being forced to liquidate any Bitcoin.

According to data from TradingView, Bitcoin has surged approximately 219% over the past five years, as of December 30, rising from roughly $27,400 to around $87,700. Gold has climbed a little over 130% over the same period.